AI-Powered Financial Services & Loan Underwriting Automation

Client

Ocrolus, Inc. is a leading AI-powered document automation and data analytics platform that empowers financial institutions to streamline and accelerate decision-making. The company specializes in automated underwriting workflows for small business lending, mortgages, and consumer loans, offering a reliable solution for the fast and accurate analysis and verification of financial documents. By utilizing machine learning and human-in-the-loop technology, Ocrolus helps lenders boost underwriting accuracy, enhance the borrower experience, scale efficiently, and minimize lending risk throughout the loan origination lifecycle.

Industry

Services

Country

Company size

The Big Picture

Ocrolus is a New York-based fintech company that automates the verification and analysis of financial documents, removing the need for manual audits. Using AI-powered technology and a human-in-the-loop infrastructure, Ocrolus streamlines the processing of bank statements, pay stubs, and other financial data, helping lenders accelerate and improve the underwriting process .

Ocrolus handles e-statements, scanned documents, and mobile images from any financial institution with over 99% accuracy. By replacing slow, error-prone manual reviews with AI-driven document analysis, the platform modernizes financial data verification for lending, underwriting, and other finance-related industries, improving overall speed, accuracy, and operational scalability.

Turning Complexity Into Clarity

One of the main challenges Ocrolus faced was scaling operations to meet growing demand while maintaining strict SLAs. As its customer base expanded, the company relied on a traditional offshore BPO model overseas to ensure client satisfaction. While effective, this approach increased operational costs and revealed the need for a more scalable, cost-efficient solution.

To address this challenge, Ocrolus strengthened its crowdsourced data validation by enhancing its mobile app. This enabled a distributed workforce to complete paid micro-tasks, boosting scalability and flexibility. With efficient access to the crowd, Ocrolus processed higher document volumes without expanding its BPO operations, reducing costs while maintaining accuracy.

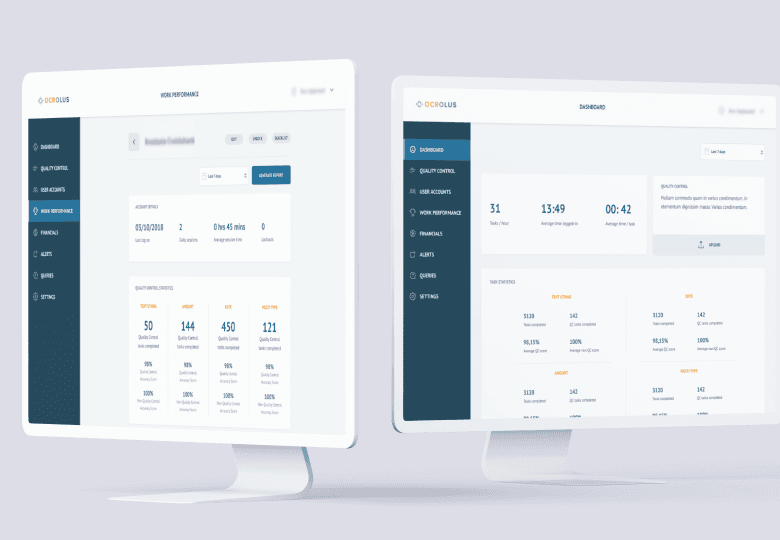

Engineering Highlights

The mobile app integrates seamlessly with an administrative website that lets admins to configure pricing, process payments to verifiers, edit user information, and monitor platform statistics. It supports users with captcha-style data validation tasks, while managers access powerful tools to upload bank statements, analyze income and performance metrics, and customize platform settings for efficient financial document processing.

The system includes multiple modules optimized for optimal performance. The web platform, developed in Angular 6.0, offers high responsiveness and a seamless single-page application (SPA) experience. For mobile users, the app runs on Android, offering all core functionalities. It’s built using cutting-edge technologies like Kotlin, RxJava, and Dagger 2 to ensure smooth, efficient performance across devices.

What we worked on:

Turning Goals into Success

Revolutionizing FinTech operations by eliminating manual inefficiencies and enabling scalable growth through intelligent automation and advanced AI-driven workflows.

Automate loan application processes in less than 10 days and be open to applications post go-live.

Over 90% of loan applications processed within 30 minutes.

400,000 bank statement pages processed and analyzed every month for each business client.

As a lean startup ASSIST provided the manpower and expertise to not only translate our vision into a robust product offering but also helped optimize our design and user experiences. Whenever we had a problem or inquiry, the ASSIST team was attentive and responsive. I am thankful that we engaged with ASSIST and I look forward to continuing our partnership.

From product design to development & completion. We guarantee exceptional products.

JRNI

Smart Software for Betting, Fintech & Beyond

Online betting game development

Scalable, secure and streamlined solutions for your business success

For business inquiries:

hello@assist.ro

Our address:

1 Tipografiei Street 720043, Suceava, Romania

Frequently Asked Questions

1. Can you integrate AI into an existing software product?

Absolutely. Our team can assess your current system and recommend how artificial intelligence features, such as automation, recommendation engines, or predictive analytics, can be integrated effectively. Whether it's enhancing user experience or streamlining operations, we ensure AI is added where it delivers real value without disrupting your core functionality.

2. What types of AI projects has ASSIST Software delivered?

We’ve developed AI solutions across industries, from natural language processing in customer support platforms to computer vision in manufacturing and agriculture. Our expertise spans recommendation systems, intelligent automation, predictive analytics, and custom machine learning models tailored to specific business needs.

3. What is ASSIST Software's development process?

The Software Development Life Cycle (SDLC) we employ defines the stages for a software project. Our SDLC phases include planning, requirement gathering, product design, development, testing, deployment, and maintenance.

4. What software development methodology does ASSIST Software use?

ASSIST Software primarily leverages Agile principles for flexibility and adaptability. This means we break down projects into smaller, manageable sprints, allowing continuous feedback and iteration throughout the development cycle. We also incorporate elements from other methodologies to increase efficiency as needed. For example, we use Scrum for project roles and collaboration, and Kanban boards to see workflow and manage tasks. As per the Waterfall approach, we emphasize precise planning and documentation during the initial stages.

5. I'm considering a custom application. Should I focus on a desktop, mobile or web app?

We can offer software consultancy services to determine the type of software you need based on your specific requirements. Please explore what type of app development would suit your custom build product.

- A web application runs on a web browser and is accessible from any device with an internet connection. (e.g., online store, social media platform)

- Mobile app developers design applications mainly for smartphones and tablets, such as games and productivity tools. However, they can be extended to other devices, such as smartwatches.

- Desktop applications are installed directly on a computer (e.g., photo editing software, word processors).

- Enterprise software manages complex business functions within an organization (e.g., Customer Relationship Management (CRM), Enterprise Resource Planning (ERP)).

6. My software product is complex. Are you familiar with the Scaled Agile methodology?

We have been in the software engineering industry for 30 years. During this time, we have worked on bespoke software that needed creative thinking, innovation, and customized solutions.

Scaled Agile refers to frameworks and practices that help large organizations adopt Agile methodologies. Traditional Agile is designed for small, self-organizing teams. Scaled Agile addresses the challenges of implementing Agile across multiple teams working on complex projects.

SAFe provides a structured approach for aligning teams, coordinating work, and delivering value at scale. It focuses on collaboration, communication, and continuous delivery for optimal custom software development services.

7. How do I choose the best collaboration model with ASSIST Software?

We offer flexible models. Think about your project and see which model would be right for you.

- Dedicated Team: Ideal for complex, long-term projects requiring high continuity and collaboration.

- Team Augmentation: Perfect for short-term projects or existing teams needing additional expertise.

- Project-Based Model: Best for well-defined projects with clear deliverables and a fixed budget.

Contact us to discuss the advantages and disadvantages of each model.